Introduction to the Indian Stock Market

The Indian stock market is one of the most dynamic and fastest-growing financial markets in the world. It serves as a crucial platform for companies to raise capital and for investors to generate wealth. Over the years, the market has evolved with improved regulations, technology, and financial products, making it more accessible to retail investors. This introduction provides a detailed overview of the Indian stock market, its key components, working mechanisms, and investment potential.

1. Understanding the Indian Stock Market

The stock market is a marketplace where securities (stocks, bonds, derivatives, etc.) are bought and sold. It acts as an intermediary between companies seeking funds for expansion and investors looking for profitable investment opportunities. Investors can buy shares of publicly traded companies, which represent ownership in the company, allowing them to benefit from price appreciation and dividends.

The Indian stock market operates through two major exchanges:

A. Major Stock Exchanges in India

Both exchanges function under the supervision of SEBI (Securities and Exchange Board of India).

2. Regulatory Framework

The Securities and Exchange Board of India (SEBI) is the regulatory authority that ensures the fair and transparent functioning of the stock market. SEBI’s primary responsibilities include:

SEBI plays a crucial role in maintaining market integrity, ensuring that all participants—retail investors, institutional investors, and foreign investors—can trade in a fair environment.

3. Market Segments

The Indian stock market is divided into two primary segments:

A. Primary Market (IPO Market)

The primary market is where companies raise capital by issuing shares to the public through an Initial Public Offering (IPO). Investors can subscribe to these shares before they get listed on the stock exchange. Once the shares are listed, they can be freely traded in the secondary market.

B. Secondary Market (Stock Trading)

The secondary market is where investors buy and sell shares of listed companies. Prices fluctuate based on demand, supply, company performance, economic factors, and global market trends.

The stock exchanges (NSE & BSE) facilitate transactions electronically, ensuring liquidity and transparency in the market.

4. Stock Market Indices

Stock market indices act as indicators of overall market performance.

These indices help investors analyze market trends and make informed investment decisions.

5. How the Indian Stock Market Works

The Indian stock market operates electronically, with trades executed through brokers. Here’s how it works:

Trading occurs in two major categories:

6. Why Invest in the Indian Stock Market?

Investing in the stock market offers several advantages:

✔ Wealth Creation – Stocks have historically generated higher long-term returns than traditional savings options.

✔ Beating Inflation – Stock market returns generally outperform inflation, preserving purchasing power.

✔ Liquidity – Stocks can be easily bought and sold on stock exchanges.

✔ Portfolio Diversification – Investors can spread risk across different sectors and asset classes.

✔ Participation in Economic Growth – Investing in Indian companies allows investors to benefit from the country’s economic expansion.

However, stock market investments come with risks, and investors must conduct proper research and risk assessment before investing.

7. Key Factors Influencing the Indian Stock Market

Several factors affect the performance of the stock market:

✔ Economic Indicators – GDP growth, inflation, interest rates, and fiscal policies impact stock prices.

✔ Corporate Performance – Earnings reports, dividends, and mergers influence investor sentiment.

✔ Global Markets – International economic trends, foreign investments, and geopolitical events affect Indian markets.

✔ Government Policies – Regulations, tax policies, and monetary policies set by the RBI impact market movements.

8. Challenges & Risks in Stock Market Investing

While investing in the stock market can be profitable, it is essential to understand the risks involved:

✔ Market Volatility – Stock prices fluctuate based on market conditions.

✔ Risk of Losses – Poor investment decisions can lead to capital loss.

✔ Emotional Investing – Fear and greed can lead to impulsive decisions.

✔ Lack of Knowledge – Not understanding market trends can lead to poor investment choices.

Investors should adopt a long-term perspective, diversify investments, and stay informed to mitigate risks.

9. Conclusion

The Indian stock market is a vital financial hub, providing a platform for businesses to raise capital and for investors to grow their wealth. With proper knowledge, risk management, and long-term strategies, stock market investments can yield high returns.

As India continues to expand its economy, the stock market remains a lucrative opportunity for investors. Whether you are a beginner or an experienced trader, understanding market fundamentals is the key to making informed and profitable investment decisions.

Introduction In the dynamic world of stock trading, developing a well-researched point of view is critical for success. Whether you're a seasoned trader or a beginner, Technical Analysis (TA) serves as an invaluable tool in identifying market trends and making informed trading decisions. This blog explores the fundamentals of TA, its assumptions, and practical applications to help you navigate the stock markets efficiently.

What is Technical Analysis? Technical Analysis is a method used to evaluate securities by analyzing price movements and trading volumes. Unlike Fundamental Analysis, which focuses on a company's financials, TA relies on historical price patterns to predict future price movements. It helps traders determine key aspects of a trade, such as:

The ideal entry and exit points

The level of risk involved

The expected reward

The duration for holding a position

Technical Analysis is based on the belief that historical price movements tend to repeat themselves, allowing traders to identify trends and patterns that can be leveraged for profitable trades.

Key Assumptions of Technical Analysis TA operates on several fundamental assumptions:

Market Discounts Everything: All available information, including past price movements and external factors, is already reflected in the stock’s price.

Price Moves in Trends: Once a trend is established, prices are likely to continue moving in that direction until a reversal occurs.

History Tends to Repeat Itself: Market participants often react in similar ways to comparable market situations, creating recognizable price patterns.

Chart Types in Technical Analysis To effectively analyze stock trends, traders use various charting techniques. Some of the most popular types include:

Line Chart: Provides a basic overview of closing prices over a specific time frame.

Bar Chart: Displays open, high, low, and close (OHLC) prices, offering more detailed insights.

Japanese Candlestick Chart: The most widely used chart, providing visual representation of market sentiment and trend direction.

Popular Candlestick Patterns Candlestick patterns play a crucial role in identifying trading opportunities. Here are some key patterns every trader should know:

Marubozu: A candlestick with no upper or lower shadow, indicating strong buying (bullish Marubozu) or selling (bearish Marubozu) pressure.

Doji: A candle where the open and close prices are nearly equal, signaling indecision in the market.

Hammer: A bullish reversal pattern that appears at the bottom of a downtrend.

Shooting Star: A bearish reversal pattern appearing at the top of an uptrend.

How to Use Technical Analysis Effectively? TA is best suited for identifying short-term trading opportunities rather than long-term investments. Here are a few best practices for traders:

Use Multiple Indicators: Relying on a single pattern or indicator can be misleading. Combine different tools like Moving Averages, RSI, and MACD for better accuracy.

Manage Risks Wisely: Always set stop-loss orders to limit potential losses.

Understand Market Sentiment: Recognizing bullish and bearish trends helps in making better trading decisions.

Choose the Right Time Frame: Traders should select time frames that match their trading style, whether it's intraday, short-term, or long-term analysis.

Conclusion Technical Analysis is a powerful approach to trading that helps traders make informed decisions based on historical price data. By understanding patterns, trends, and key indicators, traders can enhance their ability to predict market movements and optimize their trading strategies. While TA does not guarantee success, when combined with proper risk management and discipline, it can significantly improve trading performance.

Stay tuned for more insights from AGSSL, your trusted partner in the stock market journey!

Introduction to Fundamental Analysis

Overview: Fundamental Analysis (FA) is a method used to assess a company’s financial health and long-term growth potential. It involves analyzing financial statements, management quality, industry trends, and macroeconomic factors. Unlike Technical Analysis, which focuses on stock price movements, FA helps investors make informed decisions based on a company's actual performance.

Key Concepts:

Types of Fundamental Analysis:

Becoming a Fundamental Analyst: Anyone with basic financial knowledge and a structured approach can analyze stocks using FA.

Essential Tools for FA:

Mindset of an Investor

Investor vs Trader vs Speculator:

Power of Compounding:

Core-Satellite Investment Strategy:

How to Read an Annual Report

Key Sections in an Annual Report:

Standalone vs Consolidated Financial Reports:

Understanding Corporate Governance:

Understanding Financial Statements

Profit & Loss (P&L) Statement

A report summarizing a company’s financial performance over a given period.

Key Components:

Balance Sheet

A snapshot of a company’s financial position at a specific time.

Key Elements:

Cash Flow Statement

Tracks how cash is generated and used by the company.

Main Sections:

Key Financial Ratios for Analysis:

Investment Decision-Making Using FA

Steps to Analyze a Stock Using Fundamental Analysis:

Common Mistakes to Avoid in FA:

Key Takeaways:

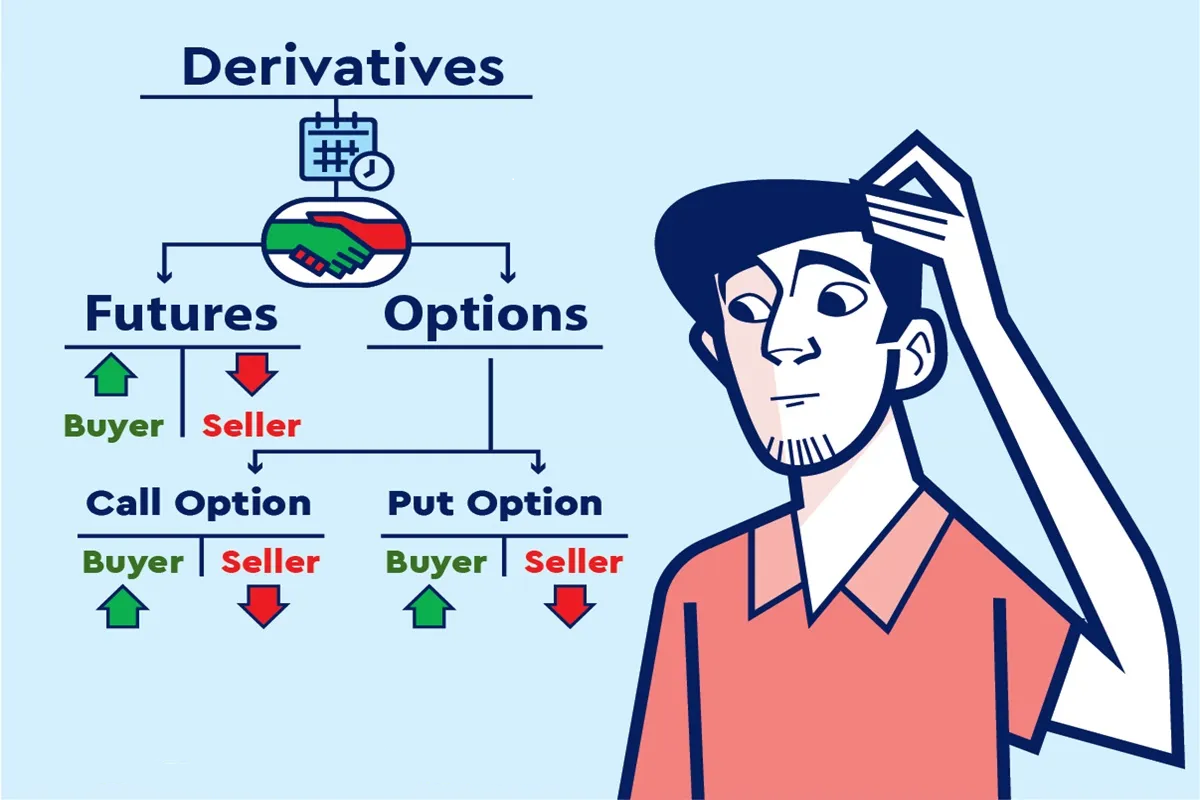

Understanding Futures Trading: A Comprehensive Guide

Futures trading is a fundamental part of financial markets, allowing traders to speculate on the future price movements of various assets. Whether you're an experienced investor or a beginner looking to explore this field, understanding the key concepts of futures trading is essential. This blog provides a detailed breakdown of futures trading, explaining its mechanics, key features, types of contracts, advantages, risks, and strategies.

1. What is Futures Trading?

Futures trading involves buying and selling contracts that commit the trader to buy or sell an underlying asset at a predetermined price on a specified future date. These contracts are standardized and traded on regulated exchanges, making them highly liquid and accessible.

Futures contracts are used for both hedging (risk management) and speculation (profit generation). Traders and investors use futures to protect their portfolios from adverse price movements or to gain from price fluctuations in stocks, indices, commodities, currencies, and interest rates.

2. How Does Futures Trading Work?

Futures trading is based on a contractual agreement between two parties:

Each contract has a specific lot size, expiration date, and settlement process. Since futures contracts are traded on an exchange, they require a margin deposit, which acts as collateral and helps maintain financial security.

Example: If an investor buys a futures contract for gold at ₹1,50,000 per 10 grams and the price rises to ₹1,55,000, they make a profit of ₹5,000 per contract. Conversely, if the price drops to ₹1,45,000, they incur a loss of ₹5,000 per contract.

3. Key Features of Futures Contracts

4. Types of Futures Contracts

Futures contracts cover various asset classes, including:

Each type of futures contract has unique factors influencing its price, such as supply and demand, economic data, and geopolitical events.

5. Benefits of Futures Trading

A. Hedging Against Market Risk

Hedging with futures helps businesses and investors reduce risks associated with price fluctuations. For example, a farmer selling wheat futures at ₹2,500 per quintal can lock in the price, ensuring stability even if market prices drop.

B. High Leverage

Futures trading requires only a margin deposit, allowing traders to control larger positions than their capital would otherwise permit.

C. Market Liquidity

Since futures contracts are actively traded on exchanges, they provide ample liquidity, enabling easy entry and exit of positions.

D. Portfolio Diversification

Investors can diversify their portfolios by trading different types of futures contracts, thereby spreading risk across multiple asset classes.

E. Price Discovery

Futures markets help determine fair prices for underlying assets based on supply, demand, and global economic conditions.

6. Risks of Futures Trading

A. Leverage Risk

While leverage can amplify profits, it can also lead to significant losses if the market moves against a trader’s position.

B. Price Volatility

Futures markets are highly volatile, and price swings can result in substantial losses if not managed properly.

C. Margin Calls

If a trade moves against a trader’s position, they may receive a margin call requiring additional funds to maintain their position.

D. Expiration Risk

Futures contracts have fixed expiry dates, and traders must either roll over their contracts or settle them before expiration.

E. Liquidity Risk

Some contracts may have lower liquidity, making it harder to exit positions quickly without significant price slippage.

7. Trading Strategies in Futures Markets

A. Trend Following

Traders use technical indicators like moving averages to identify trends and trade in the direction of the market.

B. Spread Trading

This strategy involves buying and selling related futures contracts to profit from price differences.

C. Arbitrage

Traders exploit price differences between futures and spot markets for risk-free profits.

D. Hedging

Institutions and investors use futures to protect against adverse price movements in their portfolios.

E. Scalping

A short-term strategy where traders take advantage of small price movements for quick profits.

F. Swing Trading

Traders hold positions for several days to capitalize on short-term market fluctuations.

8. Regulatory Framework for Futures Trading

Futures trading is governed by strict regulations to ensure transparency and protect investors. Regulatory bodies such as the Securities and Exchange Board of India (SEBI) oversee futures trading in India, while the Commodity Futures Trading Commission (CFTC) regulates futures markets in the U.S.

Regulations include:

9. How to Start Trading Futures?

Step 1: Choose a Reputable Broker

Selecting a SEBI-registered broker with competitive fees and good trading platforms is essential.

Step 2: Open a Trading Account

Traders need to open a futures trading account with a broker and deposit the required margin.

Step 3: Learn Market Fundamentals

Understanding market trends, economic indicators, and technical analysis helps traders make informed decisions.

Step 4: Develop a Trading Plan

A well-defined strategy, including entry and exit points, risk management, and stop-loss orders, is crucial for success.

Step 5: Start with Paper Trading

New traders should practice with a demo account before investing real money.

10. Conclusion

Futures trading is a powerful financial tool used by traders, investors, and businesses for hedging and speculation. While it offers significant opportunities for profit, it also carries inherent risks that require careful management.

To succeed in futures trading, traders should develop a sound strategy, manage risk effectively, and stay updated with market trends. If you are new to futures trading, consider starting with small positions and using risk management techniques to protect your capital.

Options Theory for Professional Trading (Indian Market Edition) 🇮🇳

The Indian stock market offers a variety of options trading opportunities, mainly on NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). This guide will break down options trading in India, including how it works, key strategies, and practical examples based on Indian stocks and indices like Nifty 50, Bank Nifty, and stocks like Reliance, TCS, HDFC Bank, etc.

What Are Options in the Indian Market?

Options are derivative contracts that give traders the right, but not the obligation, to buy (Call Option) or sell (Put Option) an asset at a fixed price before the expiry date.

In India, options trading is mainly done on the NSE through F&O (Futures & Options) contracts. The most traded options are:

NIFTY 50 options – Based on the Nifty index

BANK NIFTY options – Based on the Bank Nifty index

Stock options – Available for selected stocks like Reliance, Infosys, HDFC Bank, etc.

Options are used by traders to:

Types of Options in India

Call Option (CE) – The Right to Buy

A Call Option gives you the right to buy an asset at a fixed price.

Example:

Put Option (PE) – The Right to Sell

A Put Option gives you the right to sell an asset at a fixed price.

Example:

Summary:

Important Terms in Options Trading (Indian Market)

Strike Price → The price at which the option can be exercised (e.g., Nifty 22,100 CE).

Premium → The cost of buying an option (changes based on market demand).

Expiry Date → Options expire on the last Thursday of every month (weekly expiries for indices).

Lot Size → You cannot buy 1 option; you must buy in "lots" (e.g., Nifty50 lot = 50 units).

Intrinsic Value → The real value of an option if exercised immediately.

Time Decay (Theta) → Options lose value as expiry nears (affects buyers).

How Traders Use Options in India

Speculators: Traders bet on short-term price movements in stocks or indices.

Hedgers: Investors use options to protect against market losses.

Income Seekers: Selling options generates premium income.

Popular Option Trading Strategies (Indian Market Examples) 🇮🇳

Covered Call (For Extra Income)

Best for: Investors who already own stocks and want to make extra income.

How it works: Sell a Call Option on a stock you own and earn a premium.

Example (HDFC Bank Covered Call)

Protective Put (For Risk Management)

Best for: Protecting stock holdings from a sudden crash.

How it works: Buy a Put Option to hedge against downside risk.

Example (Reliance Protective Put)

Straddle (For Big Movements in Any Direction)

Best for: Trading events like Budget Announcements, RBI Meetings, or Quarterly Results.

How it works: Buy a Call and Put at the same strike price.

Example (Nifty Straddle on RBI Policy Day)

Iron Condor (For Sideways Markets)

Best for: When you think Nifty or Bank Nifty will trade in a range.

How it works: Sell a Call and Put to collect premiums.

Example (Bank Nifty Iron Condor)

What Affects Option Prices in India? (The “Greeks”)

Delta → Measures how much the option price moves when the stock/index price moves.

Theta (Time Decay) → Options lose value as expiry nears (affects option buyers).

Vega → Options prices increase when volatility rises (e.g., before major news events).

Gamma → Measures how fast Delta changes.

Example:

Final Thoughts: Should You Trade Options in India?

Advantages:

Small capital required (compared to stocks).

Can make money in any market direction (up, down, or sideways).

Used by professionals for hedging risks and boosting returns.

Risks:

Options expire worthless if they don’t move in your Favor.

Time decay reduces option prices quickly near expiry.

Selling options carries unlimited risk if not managed properly.

Pro Tips for Indian Traders

Always check liquidity (avoid low-volume stocks).

Be aware of event-based volatility (RBI meetings, elections, budgets).

Manage risk using stop-losses & hedging strategies.

Understanding Currency and Commodity Futures: A Comprehensive Guide

In today's dynamic global economy, understanding financial instruments that help manage risk is crucial for individuals, businesses, and institutions alike. Among these tools, currency futures and commodity futures stand out for their ability to provide hedging, speculative, and arbitrage opportunities. This guide explores what these instruments are, how they work, and why they are vital in the Indian financial landscape.

________________________________________

What Are Currency Futures?

Currency futures are standardized exchange-traded contracts that obligate the buyer to purchase, and the seller to sell, a specific amount of a currency at a predetermined price on a specified future date. These are traded on recognized exchanges like the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) in India, and globally on platforms like the Chicago Mercantile Exchange (CME).

Key Features of Currency Futures:

• Standardization: Contract size, maturity date, and tick size are standardized.

• Exchange-Traded: Ensures transparency and reduces counterparty risk.

• Mark-to-Market: Daily settlement of profits and losses ensures real-time accountability.

• Leverage: Traders can control a large position with a relatively small amount of capital.

Example Use Case:

Imagine an Indian importer who is required to pay $100,000 to a U.S. supplier three months from now. If the rupee depreciates against the dollar during this period, the importer will end up paying more in INR. To hedge against this risk, the importer can buy USD-INR futures, locking in the exchange rate.

________________________________________

What Are Commodity Futures?

Commodity futures are contracts to buy or sell a specific quantity of a commodity like gold, crude oil, wheat, or cotton at a future date and price. These are traded on commodity exchanges such as MCX (Multi Commodity Exchange) and NCDEX (National Commodity and Derivatives Exchange) in India.

Key Features of Commodity Futures:

• Physical or Cash Settlement: Depending on the contract, delivery can be physical or settled in cash.

• Hedging Tool: Protects against price volatility in commodities.

• Speculation and Arbitrage: Enables profit from price fluctuations and discrepancies between markets.

• SEBI Regulation: All contracts and participants are governed by the Securities and Exchange Board of India.

Example Use Case:

A cotton farmer anticipates harvesting 10 tons of cotton in the next six months. Concerned about falling prices, the farmer can sell cotton futures today, thus locking in the current favourable price. When harvest time arrives, even if prices fall, the farmer receives the pre-agreed rate.

________________________________________

Purpose and Benefits of Futures Contracts

Whether it’s currency or commodity, futures contracts are used for:

1. Hedging: Protects businesses and investors from adverse price movements.

2. Speculation: Allows traders to profit from expected future price changes.

3. Arbitrage: Takes advantage of price differences across markets.

Who Uses Futures?

• Importers and Exporters: Hedge against exchange rate volatility.

• Farmers and Producers: Secure prices for their goods.

• Investors and Traders: Speculate on price movements.

• Corporates and Institutions: Manage cash flows and financial planning.

________________________________________

Currency Futures vs Commodity Futures: A Comparison

Feature Currency Futures Commodity Futures

Underlying Asset Currencies (USD, EUR, INR) Physical Commodities (Gold, Oil, Wheat)

Purpose Manage forex exposure Manage commodity price risks

Major Users Exporters, Importers, MNCs, Banks Farmers, Traders, Industrial Buyers

Indian Exchanges NSE, BSE MCX, NCDEX

Risk Level Medium Medium to High

Settlement Cash-Settled Cash or Physical

________________________________________

🇮🇳 Futures Trading in the Indian Context

India has seen a steady rise in participation in futures trading. Platforms like MCX for commodities and NSE for currency derivatives offer robust infrastructure and regulatory oversight.

The Securities and Exchange Board of India (SEBI) ensures fair practices, transparency, and investor protection in the derivatives market.

In recent years, Indian investors have shown greater interest in using futures as part of their investment strategies—not just for hedging, but also for diversification and enhanced returns.

________________________________________

Educational Initiatives and Market Awareness

Recognizing the need for informed investors, Indian exchanges and brokers regularly conduct:

• Investor Awareness Programs

• Webinars and Workshops

• Online Simulation Platforms for practice trading

These programs help young traders and retail investors understand the mechanics and risks of futures contracts.

________________________________________

Key Takeaways

• Futures contracts are vital tools for managing financial risk.

• Currency futures protect against foreign exchange volatility.

• Commodity futures help producers and consumers lock in prices.

• Indian exchanges offer transparent, regulated platforms for trading.

• Education and expert guidance are crucial for new investors.

________________________________________

Conclusion

Currency and commodity futures are no longer instruments reserved for large institutions—they are accessible, useful, and increasingly essential for individual investors and small businesses in India. Whether you're an importer hedging currency risk or a farmer securing your product's price, futures offer a way to reduce uncertainty and plan confidently.

As India's financial markets evolve, understanding and leveraging futures trading can offer a significant advantage to proactive investors.

Stay tuned for more deep dives into financial tools and strategies to secure your future in the global economy!

In the world of trading, randomness often dictates short-term results. But successful traders don’t rely on luck. Instead, they build well-researched trading systems that are objective, repeatable, and measurable. In this blog, we explore the concept of trading systems, with a focus on the popular "Pair Trading" strategy, and cover advanced methods including statistical tools and real-world case studies. Let’s get started on the path to structured trading success.

A trading system is a clearly defined set of rules for entering and exiting trades. Unlike emotional or speculative trading, systems are built using logic and data. Think of it as creating a machine that makes decisions based on predefined inputs. Systems help eliminate emotional errors, enforce discipline, and allow backtesting to assess their effectiveness before deploying real capital.

Trading systems are not magic bullets. They require monitoring, tweaking, and strict adherence. But once developed, they can turn trading into a scalable and consistent practice.

Pair trading is a market-neutral strategy involving two correlated stocks. The basic idea is simple: when two historically correlated stocks temporarily diverge in price, we short the outperformer and long the underperformer, expecting the relationship to revert.

Imagine HDFC Bank and ICICI Bank. They operate in similar environments, cater to similar customers, and often move together. If one suddenly shoots up while the other remains flat, a trader might short the one that surged and buy the one that lagged, assuming the gap will close.

This strategy thrives on the concept of mean reversion and is relatively immune to broader market direction.

To identify viable trading pairs, we need tools:

Spread: Difference in daily returns of two stocks

Differential: Difference in absolute stock prices

Ratio: Price of stock A divided by price of stock B

By tracking these metrics over time, we observe patterns and anomalies. For example, a widening spread may indicate a trading opportunity.

Another vital concept is correlation, which measures how closely two stocks move together. A correlation close to +1 indicates strong positive relation, essential for successful pair trading.

Once we have a pair, we analyze its relationship statistically. We use Excel to calculate:

Daily returns

Correlation (based on prices or returns)

Spread, differential, and ratio

We also calculate basic statistics like mean, median, and mode to understand the central tendencies of these variables.

This chapter introduces normal distribution and standard deviation, which help determine how far a stock's behavior is from its average.

We set up a standard deviation table for spread, differential, and ratio. When a value falls 2 or 3 standard deviations away from the mean, it could signal a high-probability trade.

A key refinement is tracking the density curve, which gives the probability of the variable reverting to the mean.

For example:

If the density value is 0.975, the ratio is far from the mean and has a high chance of mean reversion.

This helps traders stay disciplined and avoid false signals. Tools like Excel's NORM.DIST function make it easy to implement.

With all variables aligned, it’s time to trade. General guidelines:

Go long the ratio when density is between 0.003 and 0.025

Go short when density is between 0.975 and 0.997

Monitor the ratio daily, and exit as it reverts toward the mean. Use standard deviation zones as stop-loss and take-profit levels.

These chapters introduce a more statistical approach:

Straight Line Equation using regression

Linear Regression to model expected price

Error Ratio to measure deviation

ADF Test to ensure the relationship is stationary

These methods improve reliability by grounding decisions in mathematics.

Combining the previous methods, we can now identify trades with high confidence. This involves calculating expected behavior, identifying divergence, and acting when the odds favor reversion.

Chapter 13 & 14: Live Trade Examples

Real examples show how these techniques work in the market. Each trade highlights entry, rationale, risk control, and outcome. These are powerful learning tools for traders.

A new strategy that involves buying and selling futures contracts of the same stock with different expiry dates. It benefits from time decay and volatility changes.

Chapter 16: Momentum Portfolios

Here, traders build a portfolio of high-momentum stocks, aiming to ride the trend. Selection is based on performance metrics and relative strength.

Conclusion

Trading systems transform subjective decisions into objective, testable strategies. Pair trading, with its roots in statistics and market logic, offers a fantastic entry point. By combining discipline, data, and sound risk management, traders can consistently capture edge in the market.

Happy Trading!

A Beginner's Guide to Intraday Trading: Tips, Strategies, and Essentials

Introduction

Intraday trading, also known as day trading, involves buying and selling stocks within the same trading day to profit from price fluctuations. It’s a fast-paced, high-risk, high-reward approach that appeals to those seeking quick gains. Success requires knowledge, discipline, and a solid strategy. This guide, inspired by insights from AGSSL, breaks down the essentials of intraday trading for beginners, offering practical tips to help you navigate the stock market confidently. Visit AGSSL for tools and resources to get started.

What is Intraday Trading?

Intraday trading refers to purchasing and selling stocks during a single day’s trading hours, typically between 9:15 AM and 3:15 PM in India. The goal is to profit from small price movements by closing all positions before the market shuts, avoiding overnight risks. Unlike long-term investing, intraday trading leverages volatility for immediate returns but demands quick decision-making and risk management.

Key Features of Intraday Trading:

Why Choose Intraday Trading?

Intraday trading offers unique advantages that attract both new and seasoned traders:

However, the high risk of losses and constant market monitoring make it unsuitable for everyone. Beginners must approach intraday trading with caution and preparation.

Getting Started: Steps for Beginners

To embark on your intraday trading journey, follow these foundational steps:

How to Choose Stocks for Intraday Trading

Selecting the right stocks is critical for intraday success. Here are key tips to guide your selection:

Top Intraday Trading Strategies

Effective strategies help beginners maximize returns while managing risks. Here are five proven approaches:

Essential Intraday Trading Tips

To succeed in intraday trading, adopt these best practices:

Common Mistakes to Avoid

Beginners often fall into traps that lead to losses. Here’s what to watch out for:

Tools and Indicators for Intraday Trading

To enhance your trading decisions, use these tools and indicators:

Risk Management in Intraday Trading

Effective risk management is the backbone of successful intraday trading. Follow these principles:

Conclusion

Intraday trading offers exciting opportunities for quick profits but comes with significant risks. By educating yourself, choosing liquid stocks, adopting proven strategies, and practicing strict risk management, you can increase your chances of success. Platforms like AGSSL provide valuable tools, real-time data, and educational resources to support beginners. Start small, practice with a demo account, and stay disciplined to build your skills over time.

Ready to dive into intraday trading? Open a free Demat and trading account with AGSSL to access their user-friendly platform and expert guidance. Visit AGSSL to get started today!

Call to Action